Over the past few months we have been making improvements to numerous areas of the system. A full listing is available in the features section but this month's selected features and enhancements are as follows:-

- Contractors’ database

- Improved transactions input

- Internal transaction reference numbers

- General improvements to system speed

- Improvements to update install wizard

- VAT reports

- Tax reports

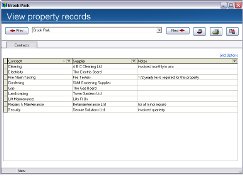

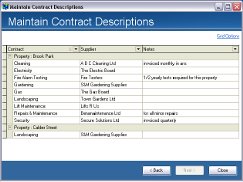

Contractors’ database

This facility allows you to record, in a centralised database, contracts held with each supplier both at supplier level and property level.

As each contract (e.g. cleaning, gardening, lift maintenance etc) is added, this is linked through to the appropriate supplier or property allowing you to view all contracts for a particular supplier or a specific property.

As well as seeing the contract as supplier and/or property specific, you can also view the contracts set up across the whole portfolio with additional features of filtering, grouping, sorting etc the required contract information.

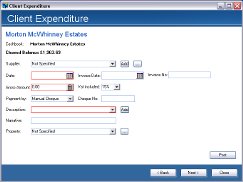

Improved transaction input

When posting expenditure transactions, the screens have been improved to make data input more efficient. When logging or paying expenditure the supplier field is now the first field to complete (to make the process of automatic cheque writing and BACS exporting more efficient) and the fields that must be filled in for the system to process the transaction are now red, allowing less input in some instances.

Internal transaction reference numbers

Manual expenditure reference number

When posting expenditure you can assign a reference number (meant for internal use) to the transaction and this number can be seen on various screens and reports throughout the system.

Automatic expenditure reference number

When posting expenditure the system can automatically assign a reference number (meant for internal use) to the transaction and this number can be seen on various screens and reports throughout the system.

General improvements to system speed

Various areas of the system have been sped up to make general day to day use of the system faster and more efficient. Some of these areas include:-

- Faster loading of records

- Improved speed when collating information for the cashbook record debit and credit tabs

- Improved speed when collating information for the cashbook, client, property and tenant ledgers

- Improved speed when collating information for cashbook reconciliations and service charge year end reconciliations

- Faster loading of diary events and improved filtering, grouping and sorting of events

Improvements to update install wizard

The way you install system updates (free to users that subscribe to software support) was changed a while ago to make installing new features easier. We have now made improvements to this wizard so that the on screen wizard will now display information about the update just installed and the version overwritten so that Users know that new features are installed seamlessly.

VAT reports

We have overhauled the way the system presents VAT report information. You can now generate automatic vat reports on either a 'cash' basis or a 'due' basis calling in all income and expenditure within any required date span.

The report itself shows a summary of all nett and vat income and expenditure (calculating how much is to be paid to HMRC) and will detail the transactions making up this amount. If the standard report layout does not suit, an alternative report can be designed specifically for you and you should contact Support for costings if this is your preference.

Tax reports

We have overhauled way the system presents tax report information. You can now generate automatic tax reports (section 19) calling in all income within any required date span.

There is a choice of report (detailed or summarised) with the detailed report itemising each transaction for each tenant and the summarised report totalling the transactions for each tenant. If the standard report layouts do not suit, alternative reports can be designed specifically for you and you should contact Support for costings if this is your preference. Once the report has printed a csv file will be generated automatically, allowing you to submit the tax return to HMRC with ease.

All of the features listed above are available free of charge to all users currently subscribing to Software Support (subject to compatibility with your current settings). If you would like to discuss any of the options or request an option to be included on your next update, please speak to Support.